For anyone looking to get high cash flow and passive income..

Make 3x Return of Investment (ROI) in 5 years

with high 8% Capital Appreciation, high 7% rental yield, low 10% upfront downpayment and no ABSD

by investing in Freehold Property in the Philippines (no foreign purchase limitations) that are 5-7 times cheaper

Watch the video below 👇

Hit play on the video

Market Insights, Discover Property Options

Learn About Financing & Personalized Support

No Obligations &

No Foreign Ownership Restrictions

Dear Property Investor,

Daniel here!

Investing in properties in Singapore no longer yields high returns. They have low ROI and the little appreciation is canceled out by condo maintenance expenses, bank interest rates, high real estate transaction fees, stamp duties, property taxes, inflation and CPF interest.

Did you know that a study analyzed data from the previous 20 years and found that about half of private properties have annual gains that do not surpass the CPF OA rate of 2.5%?

Additionally, the very low rental yield of 1-2% and the requirement of a 25% down payment lead to negative or very low cashflow.

And that’s not even considering the ongoing rounds of cooling measures. You already know that there is a huge tax on the second purchase of property and beyond, along with the Total Debt Serving Ratio (TDSR) and other heavy restrictions.

All these factors, combined with the huge upfront financial commitment in terms of down payment and little diversification makes investing in Singapore property unappealing.

Some investors have even said that their investment condos "have not made any money for the past 10 years”.

The solution means..

You Never… have to worry about depreciating or low appreciation in units

You Never… have to worry about what the government might do unexpectedly to cool property prices

You Never… have to worry about mortgage stress from negative gearing

Instead It Means That… you have a smoother and much faster path to retirement and wealth-building.

Instead It Means That… you can play the property game again, just like investors in the past

Instead It Means That… you can generate actual income, as previous generations have done. You can reinvest much quicker and build a property portfolio

Market Insights, Discover Property Options

Learn About Financing & Personalized Support

No Obligations & No Foreign Ownership Restrictions

The Solution: Invest in Freehold property in the Philippines

1) Low Mortgage Stress and Affordable Units

Properties in the Philippines are 5 to 7 times cheaper than those in Singapore, allowing you to avoid overcommitting capital for the down payment. This frees up funds for other investments.

2) Accumulate Wealth with High Annual Capital Appreciation

Philippine properties have averaged 8% yearly capital appreciation over the past 10 years despite economic setbacks. This growth mirrors Singapore's rise from 1975-1995, where property values increased tenfold. Many Filipinos working in Singapore have returned home owning multiple properties.

3) Maximize leverage with low 10% upfront downpayment

You can leverage your investment with a low 10% upfront downpayment.

4) Quick Returns with High 7% Rental Yields (some even more with Airbnbs allowed)

Condos in prime locations can yield 5-8%, averaging around 7%. This generates cash flow, allowing for quicker reinvestment. Some properties even permit Airbnb rentals for higher yields.

5) Easy flip with no seller stamp duty and no foreign ownership restrictions

There’s no seller stamp duty in the Philippines, allowing for easy flipping of properties. Additionally, there are no foreign ownership restrictions, enhancing market demand. With a growing population and low rental supply, finding quality tenants is easy.

6) Maximize upfront returns with no ABSD

The absence of Additional Buyer's Stamp Duty (ABSD) means you retain the full value of your investment without additional taxes.

7) 100% passive income with Property Management

Property managers handle everything from maintenance to renting, providing a hassle-free experience for you.

Market Insights, Discover Property Options

Learn About Financing & Personalized Support

No Obligations & No Foreign Ownership Restrictions

Invest in the Philippines

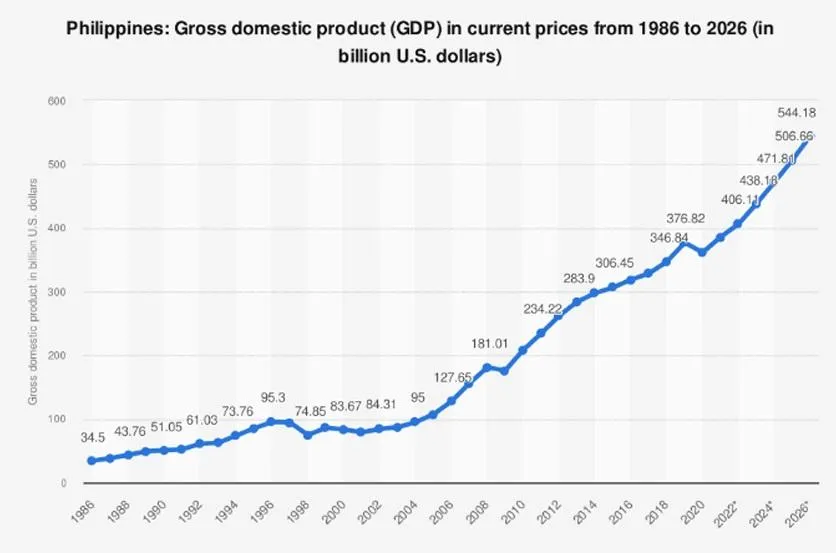

High, consistent, rising GDP

Stage of massive infrastructure growth

The Philippines is spending US$164.7 billion as part of the ‘Build, Build, Build’ Program, creating exciting opportunities for investment and development

Huge Upside: Extremely low Price Per Sq Meter

Market Insights, Discover Property Options

Learn About Financing & Personalized Support

No Obligations & No Foreign Ownership Restrictions

©InvestinthePhilippines